The Squeeze Out

How ordinary people get poorer and poorer while the rich take it all

Look around: governments slash benefits, raise your taxes, and tell you to “tighten your belt”. Meanwhile, the rich gorge themselves. This isn’t an accident.

Gary Stevenson calls it the squeeze out. The relentless process where the wealthy use their money to outbid everyone else, pushing the working class, the middle class, and even our governments further and further into poverty.

While they accumulate mansions, stocks, and power, we’re left with debts, disappearing homes, and declining futures.

If nothing changes, you and your family will be stripped of your wealth piece by piece. Here’s how it happens.

Stage 1: The Flood of Money

In the 1980s, governments slashed taxes on the rich. Overnight, the wealthiest people began stockpiling enormous sums of money.

Here’s a crucial point: rich people don’t spend new money the way ordinary families do. Yes, the rich buy yachts, mansions, and private jets. But no matter how much their wealth grows, their consumption can’t scale up in the same way.

Imagine a middle-class family earning $50,000 a year. If their income suddenly doubles, life changes dramatically. They move to a bigger house, take more vacations, maybe even send their kids to a better school. Almost every extra dollar flows straight into new spending. Now picture a billionaire. If their wealth doubles, they don’t suddenly buy ten extra yachts, or another garage full of Ferraris. That’s what economists call a low marginal propensity to consume.

So what do the rich do instead? They pour that money into assets : houses, land, stocks, gold, businesses. And the effect is immediate. The rich bid against each other and the price of everything they buy starts climbing.

At first, stage one feels fantastic. Asset prices are rising — stocks, houses, everything. Even ordinary people celebrate. “My house is worth more! My retirement account is growing! This is great!”

But what looks like free money is actually the first turn of the squeeze. Rising asset prices are not a gift, they’re the result of the rich pouring their money into the market, outbidding weaker owners. And the weakest owners are the first to give in.

Poorer families often respond by selling. Think of older people from working-class backgrounds: after a lifetime of struggle, a rising house price feels like a chance to finally enjoy some comfort. They cash in, and for a while, life feels better.

This is what economists call dis-saving. It’s when you sustain your lifestyle not from income, but by selling the assets you own — or by taking on new debt. For the working class, dis-saving means trading away homes, stocks, or land to the rich in exchange for short-term comfort.

My working-class grandparents had a house like that in the 1960s and 70s. They sold theirs in the 1980s to fund retirement. By 2020, a similar one — fully renovated — was listed for more than $1M CAD.

Source: Silo57

Source: Silo57

So in the early years, living standards don’t collapse. In fact, they often rise. Families spend more, enjoy better retirements, take holidays. But underneath, wealth is draining away. Ownership shrinks, especially among the working class. And with each cycle of selling, the rich scoop up more assets while ordinary families lose their foothold. Over time, fewer and fewer working-class families own homes. Property prices keep climbing. Debt swells as families borrow more just to keep up — bigger mortgages, more loans, more dependence on the wealthy.

Eventually, the rich look down and say: “You’ve got no assets left. You’re drowning in debt. And now, you’re not even creditworthy anymore.”

That’s the breaking point — and that’s when we enter stage two of the squeeze out.

Stage 2: The 2008 Credit Crash

Stage two begins when a huge chunk of society hits a wall: they can’t borrow anymore.

This is what happened in 2008. Up until then, ordinary families were already being squeezed out of asset ownership, but they could still keep spending, because the rich were lending them the money. Bigger mortgages, more credit cards, endless loans. But eventually, the wealthy decide: “These people aren’t good credit anymore. We’re done lending.” And when that happens, the machine breaks. Suddenly, millions of people can’t borrow, which means they can’t spend.

That collapse in spending triggers a chain reaction. Businesses lose customers and shut their doors. Workers lose jobs. Incomes vanish. Poverty surges. It’s the first moment in the squeeze out where the rich aren’t just stripping you of your assets — they’re actively cutting off your ability to consume.

People out here hurtin man, ??????????? he ain't got nuttin yet, man I make 12 dollars an hour. gas is $3.79, $4.29 after that how ima pay my, how take care my kids after that — The Recession (Intro), Jeezy, 2008

What follows is an economic depression. Entire communities are thrown into crisis, and governments are forced to step in as lenders of last resort, trying to patch up an economy that has been hollowed out by decades of extraction.

Stage 3: The Government Squeeze

When the crash hits, governments step in. They try to protect living standards, to keep society from collapsing outright. But over time, the state itself gets dragged into the squeeze.

The problem is simple: the rich keep getting richer. They own the assets, while the working class owns less and less. To fund social programs, benefits, and public services, governments need resources from the wealthy. But instead of taxing them, politicians turn to the rich and ask: “What will it take for you to let us support our people?” And the answer is always the same: “We’ll lend you the money, if you hand over your assets.”

So the same cycle that hit the working class in Stage one now plays out at the level of the state. Governments dis-save: they privatize public assets, pile up debt, and grow poorer year after year.

Take Greece. Crushed by debt and under pressure from the EU and IMF, the government sold airports, ports, and utilities. Short-term cash came in, but the public lost ownership of assets that had belonged to them for generations. Prices rose, and long-term revenues flowed straight to private investors instead of the state.

Or look at Chicago. Desperate for funds, the city leased its parking meters to Wall Street for 75 years. Overnight, fees skyrocketed. Investors pocket profits for decades, while the city gave up control of its own streets for a one-off payout.

Meanwhile, asset prices climb higher, and the rich consolidate even more power.

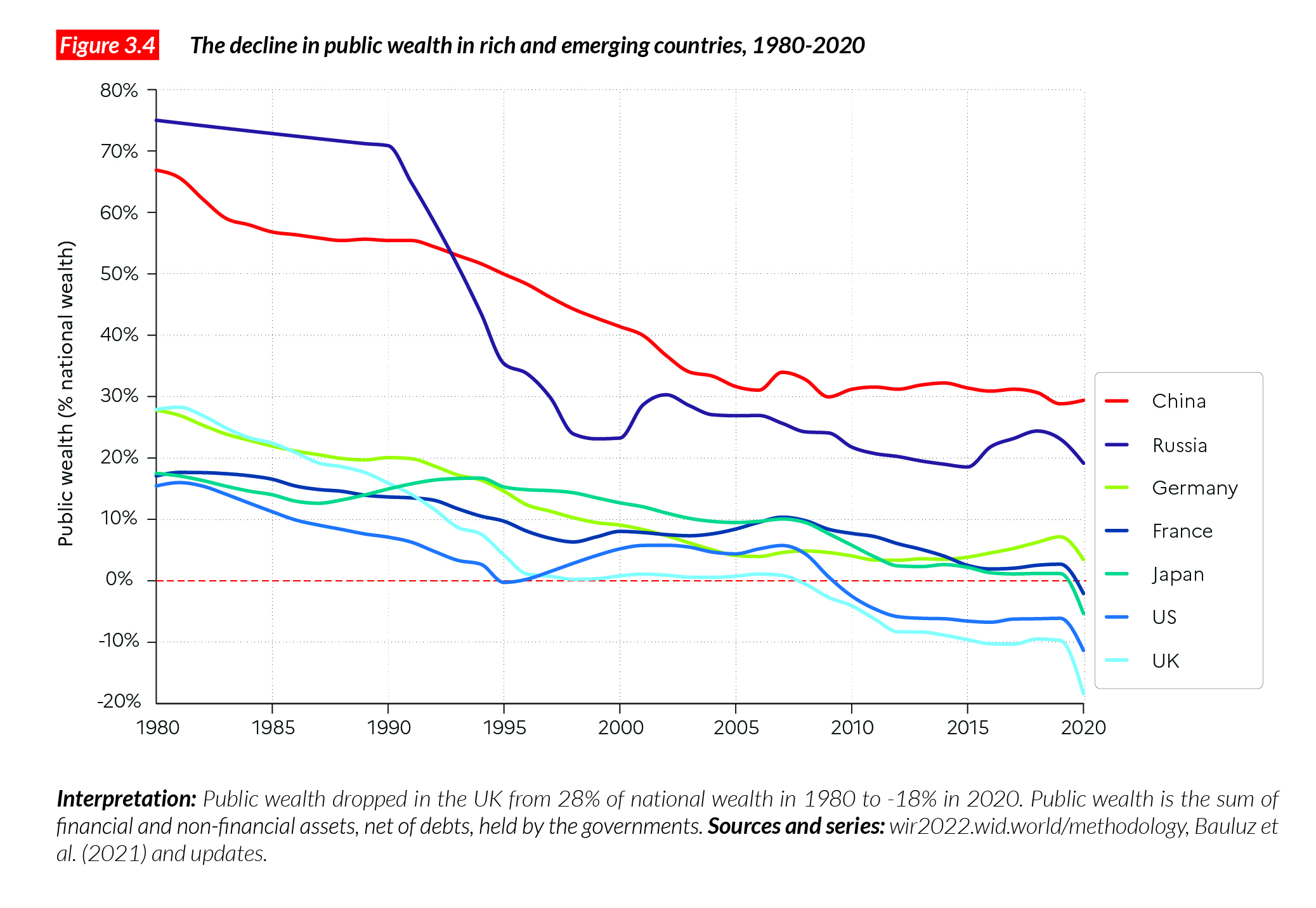

Economist Thomas Piketty’s data makes this plain. In the last twenty years, the net wealth of major Western governments, the balance of assets minus debt, has collapsed to zero. And since COVID, it’s plunged far below zero. Today, the U.S. and European governments are in negative wealth territory. States themselves are now trapped in the same position as the poor: fewer assets, more debt, less freedom.

Source: World Inequality Lab

Source: World Inequality Lab

Stage 4: The Shutdown

Stage four is where we are now. After decades of trying to protect ordinary people from being squeezed out, governments themselves have been drained of wealth. The state has sold its assets, loaded up on debt, and now has nothing left.

There is one obvious solution: tax the rich.

But while that remains politically untouchable, governments choose a different path — they dismantle the welfare state.

We are sliding back toward a pre–World War II world, where all wealth, assets, and power are concentrated in the hands of the elite. The working class has nothing left. Governments have nothing left. And so, one by one, the pillars of public life begin to collapse: local services shut down, welfare contracts, courts and police lose funding, schools and hospitals erode. What’s left is being stripped away piece by piece.

With nothing left to sell, governments turn to the only group that still holds a fragment of wealth: the middle class. Taxes rise on them, while the rich continue to lend to the state, further enriching themselves. But this only accelerates the cycle. The middle class becomes the next weakest hand, squeezed out just as the working class and governments were before them.

The result is a society where nobody holds wealth except the elite. The physical world around us changes to reflect that. For seventy years, industrialized nations built housing, healthcare, education, and consumer goods for working and middle-class people. That era is ending. Economies are shifting to produce only for the rich.

History gives us grim precedents. In 19th-century Ireland, food was exported to the wealthy while the poor starved. In colonial India, fields grew tea for foreign elites while locals went hungry. The same logic is re-emerging today. Walk through central London: luxury flats, restaurants, hotels, and boutiques rise everywhere, full of rich people — while ordinary families are priced out, excluded, and left behind. If you’re working-class, you’ve felt this reality for a long time. If you’re middle-class, you may only just be realizing that it’s coming for you too. The pattern is brutally consistent: first the working class is squeezed out, then governments, then the middle class, until only the rich remain.

Unless governments finally confront the root cause — unless they tax the rich — this squeeze out will only intensify. Every year it will get worse.

Tax wealth, not work.

///

Share it with your friends, share it with your family, send it to your mum.